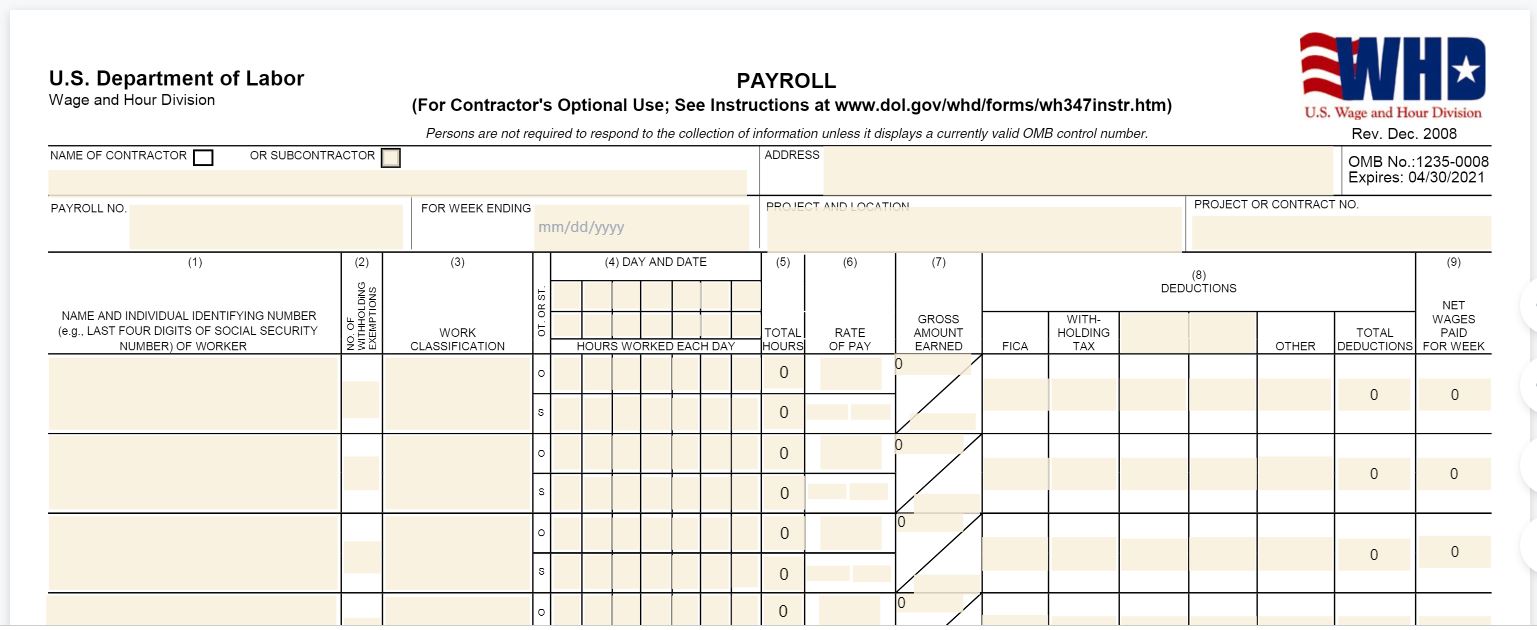

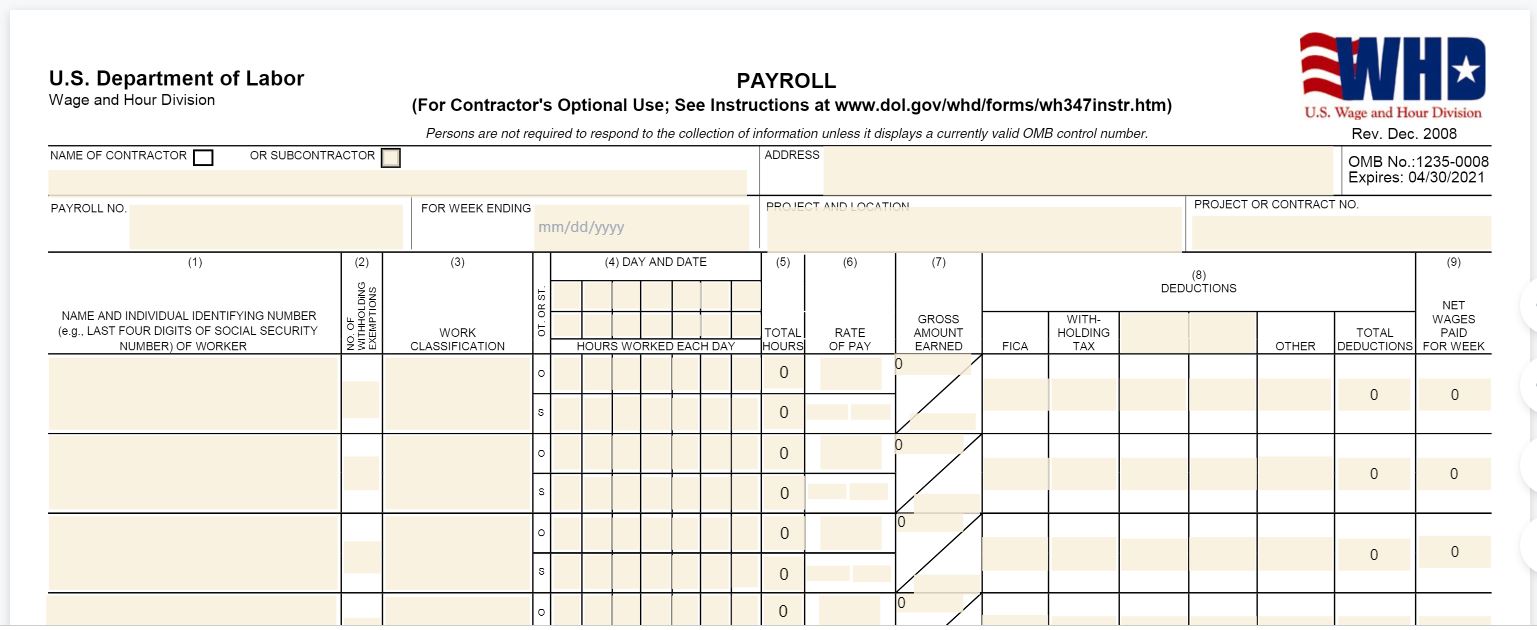

In prevailing wages and in wage determinations, there are certain pertinent documents that contractors must comply. One of these is the WH-347 or the Optional Payroll Submission Form which is used to report the hours worked on one project. Contractors can submit certified weekly payrolls on this form for contracts covered by the Davis-Bacon and related Acts.

Each form is only supposed to include the hours for that particular project listed at the top of the sheet. If there are more than one project that needs to be reported for a person in a week, then separate forms are needed.

The Davis-Bacon Related Acts require contractors and subcontractors to provide employees with wages that are at least equal to the prevailing wage, as well as fringe benefits and other privileges predetermined by the Department of Labor. Thus, the WH-347 or payroll form will prove the salary being paid to the workers and other bona fide benefits they are receiving.

The availability of WH-347 Form is for the convenience of contractors and subcontractors who are obliged to report weekly payrolls under the respective Federal or Federally-aided construction projects. This form, when properly completed, meets the requirements of Regulations, Parts 3 and 5 (29 C.F.R., Subtitle A), in relation to payrolls filed in connection with contracts covered by the Davis-Bacon and related Acts.

While Form WH-347 completion is voluntary, it is required for covered contractors and subcontractors working on Federally supported or assisted construction contracts.

Pro tip: One project per form. You can list as many people as you like. Just keep it to one project.